What really happened when stock brokerages closed Gamestop?

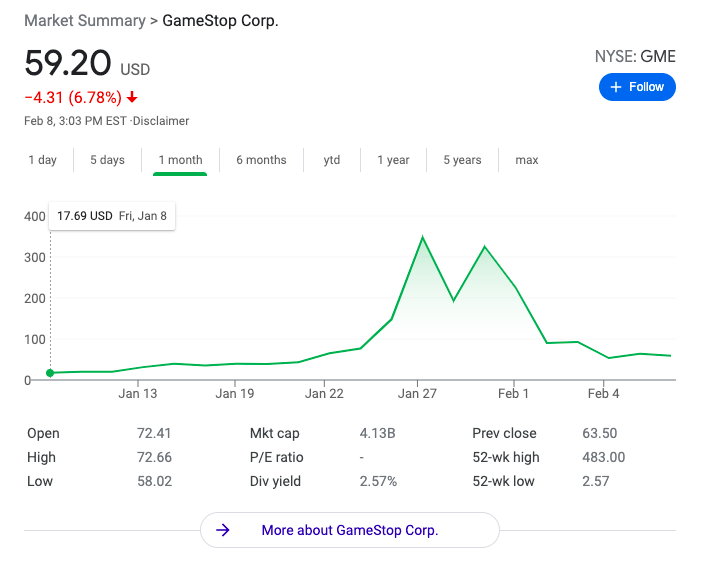

In the last few days, the Gamestop short squeeze has been all over the news, but increasingly murmurs have started to arise about market manipulation from hedge funds and stock brokerages to plunge the price and screw over the average investor.

During the squeeze, several stock brokerages, including Robinhood, restricted stock buying of tickers such as GME, AMC, NOK, etc. Immediately, theories came blasting out the door about how Robinhood and these other brokers were in cahoots with the very hedge funds that retail investors were declaring war against. People declared that they must be colluding to manipulate the market and leave the little guy holding all the bags. We do not have enough information to confirm or deny the validity of these accusations completely, but stockbrokers had a good reason to restrict trading.

As the volatility of GME and a few other stocks rapidly increased, the Depository Trust & Clearing Corporation increased the deposit requirements for stock brokerages ten-fold. For those unaware of what the DTCC is, they are an “intermediary, or “middleman,” between buyers and sellers of financial assets.” They are heavily regulated by the SEC and responsible for ensuring the validity of transactions between every buyer and market maker (to put it in perspective, during 2014, the DTCC processed around $1.6 quadrillion worth of transactions). When the DTCC sharply increased the deposit requirement on equities, the younger stock brokerages such as Robinhood, E-Trade, WeBull, and M1 finance found themselves between a rock and a hard place. They did not have the same large credit lines and backup pools of capital that more developed firms like TD Ameritrade and Fidelity had and could not afford to allow users to buy shares, or else they would be in violation of the Dodd-Frank Wall Street Reform and Consumer Protection Act, but at the same time doing so would alienate much of their customer base. As one can infer, they were forced to choose the latter.

In conclusion, most market manipulation theories about Robinhood actively attempting to hurt retail investors do not seem to hold ground. However, until we can re-examine this case with more information in the future, we cannot definitively guarantee that Robinhood and other stock brokerages’ recent actions were not market manipulation. Until then, we can only assume that these brokerages were playing by the rules.